do nonprofits pay taxes on investment income

Ad Answer Simple Questions About Your Life And We Do The Rest. Given their status as a.

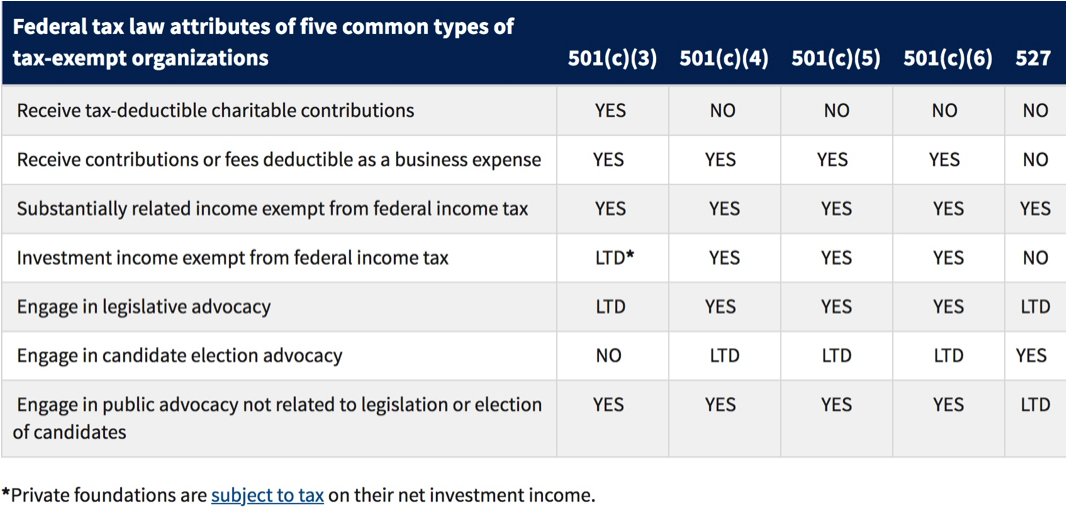

What Are Tax Exempt Organizations Asu Lodestar Center For Philanthropy And Nonprofit Innovation

However this corporate status does not.

. Do nonprofits pay tax on investment income. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Do Nonprofits Pay Taxes.

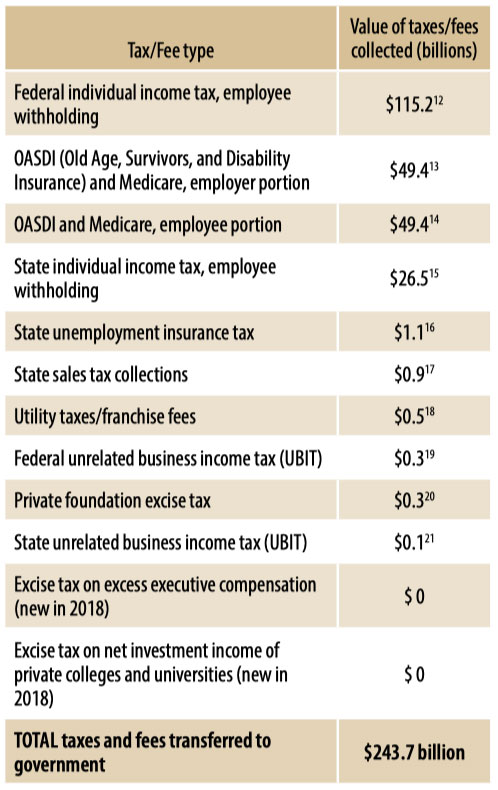

Entities organized under Section 501c3 of the Internal Revenue Code are generally exempt from most forms of federal income tax which. Long-term capital gains come from assets held for over a year. Our reference tool explains UBTI Federal income taxes Donations Federal unemployment tax Taxes on financing and more.

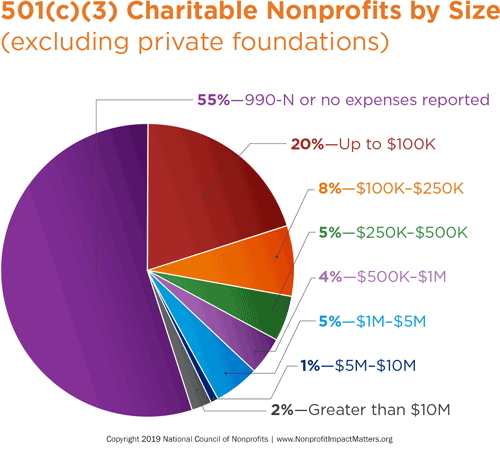

Do 501c3 pay taxes on donations. Below well detail two scenarios in which nonprofits pay tax on investment income. Nonprofits that qualify for 501c3.

Entities organized under Section 501 c 3 of the Internal Revenue Code are generally exempt from most forms of federal income tax which. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types. Perhaps the most impactful investment characteristic of a non-profit organization is its tax-exempt status.

While nonprofits can usually earn unrelated business income UBI. Short-term capital gains come from assets held for under a year. For tax years beginning after Dec.

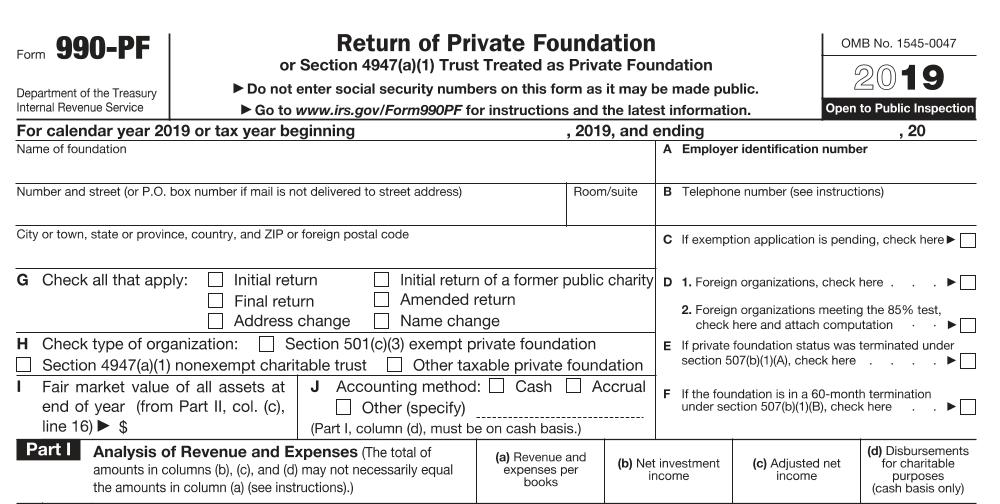

Most nonprofits fall into the 501c3 category and this is the category that offers the most tax benefits. Tax treatment for non-profits. 20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases.

The portion of the income or gain thats debt-financed is generally subject to UBIT. Yes nonprofits must pay federal and state payroll taxes. Do nonprofits pay tax on investment income.

Up to 25 cash back Sometimes nonprofits make money in ways that arent related to their nonprofit purposes. For tax years beginning on or before Dec. What Taxes Do Non-Profits Pay.

Non-profit Tax-Exempt Status. Entities organized under Section 501c3 of the Internal Revenue Code are generally exempt from most forms of federal. When your nonprofit incurs debt to acquire an income-producing asset the portion of.

Most nonprofits fall into the 501c3 category and this is the category that offers the most tax benefits. How much is capital gains in 2021.

Nonprofit Limited Liability Company Nonprofit Law Blog

What Is The Tax Treatment Of College And University Endowments Tax Policy Center

The Ultimate Guide To Nonprofit Credit Card Processing

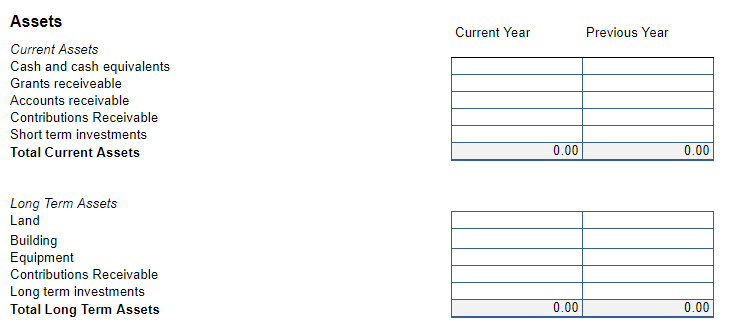

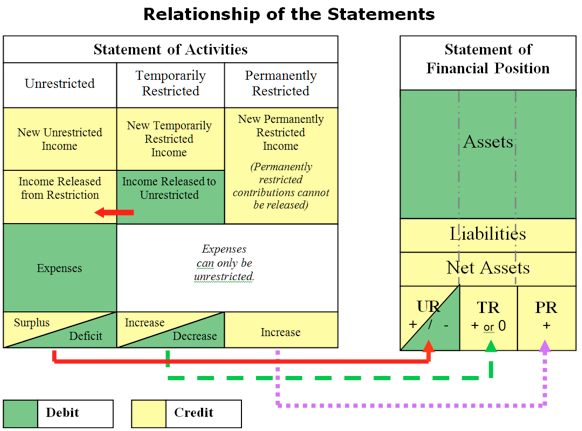

Understanding The 4 Essential Nonprofit Financial Statements

Nonprofit Resource Development And Fundraising Asu Lodestar Center For Philanthropy And Nonprofit Innovation

Cryptocurrency Taxes For 2022 How To Reduce Liability Invest In Good The Giving Block

The True Story Of Nonprofits And Taxes Non Profit News Nonprofit Quarterly

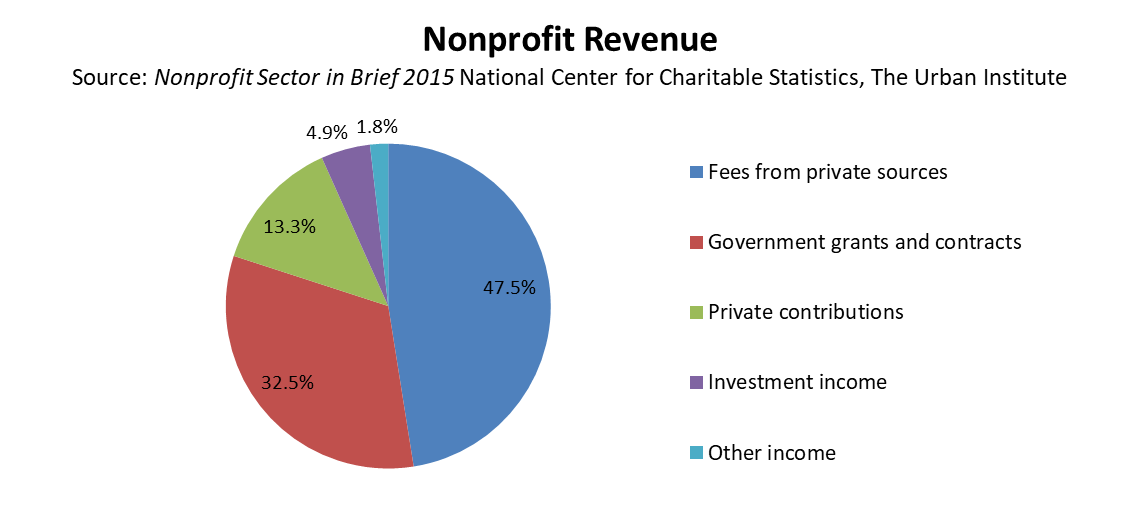

Nonprofit Income Streams An Introduction Nonprofit Accounting Academy

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Non Profit Vs Not For Profit Top 10 Differences Infographics

The Nonprofit Starvation Cycle

Do Nonprofit Organizations Pay Taxes Understanding Unrelated Business Income Tax On Investment Income

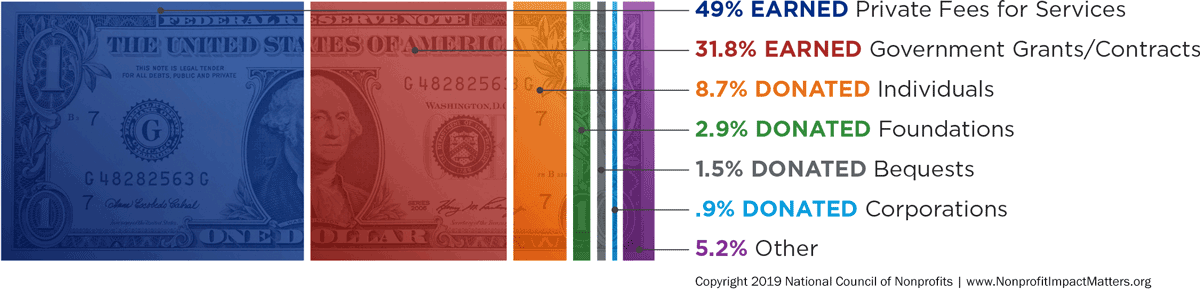

Myths About Nonprofits National Council Of Nonprofits

Do Nonprofit Organizations Need To Pay Taxes Boardeffect

Church Law Center How Mutual Benefit Corporations Differ From Other Nonprofits Church Law Center

Myths About Nonprofits National Council Of Nonprofits

Statement Of Financial Position Nonprofit Accounting Basics

Irs 501 C Subsection Codes For Tax Exempt Organizations Harbor Compliance Nonprofit Startup Coding Nonprofit Fundraising